CRM for Banking

The digital transformation has significantly changed not only the ways of interacting with clients but also the ways of operating the internal processes and supporting business infrastructure. It is difficult to imagine modern companies operating without automation of their accounting, document flow, and other routine operations. This is particularly true of the banking industry. The implementation of the latest software solutions helps businesses overcome a lot of challenges connected with retaining clients, streamlining business processes, and increasing business productivity.

The workflow of financial institutions has been totally transformed over the last decades. Banks are no longer the dusty vaults, high counters, and lines of people waiting to receive service. Modern banks are complex organizations that aim at meeting customer expectations and have a digitalized business model at their core.

Needless to say, present-day customers expect their banks to offer more than relatively simple services such as withdrawals, deposits, credit history checks and loans. More and more often, they are looking for competent financial advice, first-class customer service, and support in making important financial decisions. All of that is impossible without an in-depth knowledge of its clients and a holistic view of customer needs.

Fortunately, there is a solution that helps to create seamless and personalized customer experiences, and it’s known as a customer relationship management (CRM) systems. Apart from allowing the bank to focus on each customer’s requirements, a CRM system can also increase the bank’s ratings and revenues by greatly improving the performance of employees and the overall efficiency of the institution.

So, what can a CRM system do for companies in the banking sector?

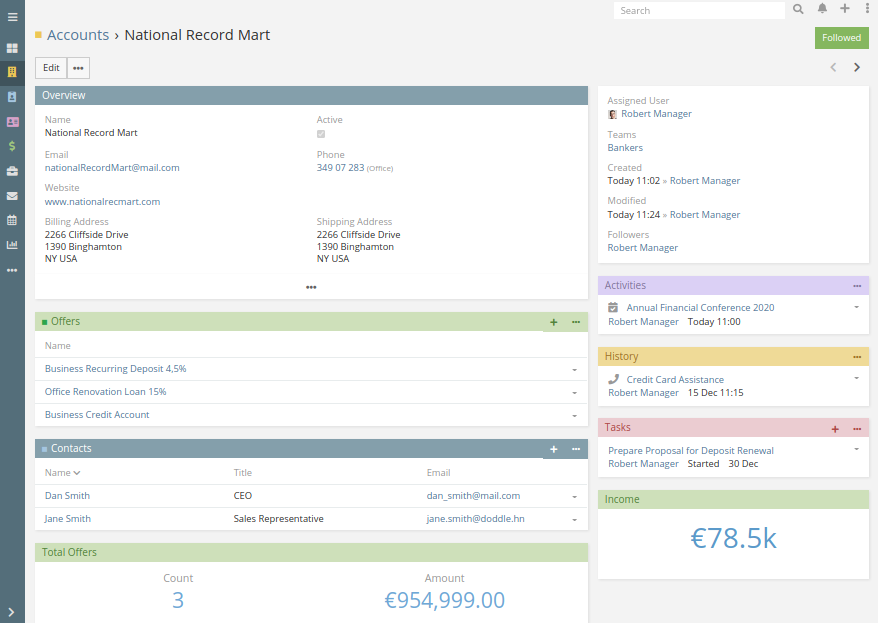

CRM equips employees with holistic customer profiles

First of all, the CRM system stores detailed information about customers, their transactions, and the bank’s interactions with them in a single database. Since the process is fully automated, this means exceptional accuracy and increased efficiency, and also ensures that every customer will receive the due attention. By relying on a single database, banks are assured that their employees get the full picture of the customer needs and can quickly find all relevant information about any customer with whom they’re dealing, without wasting any of their and the client’s time.

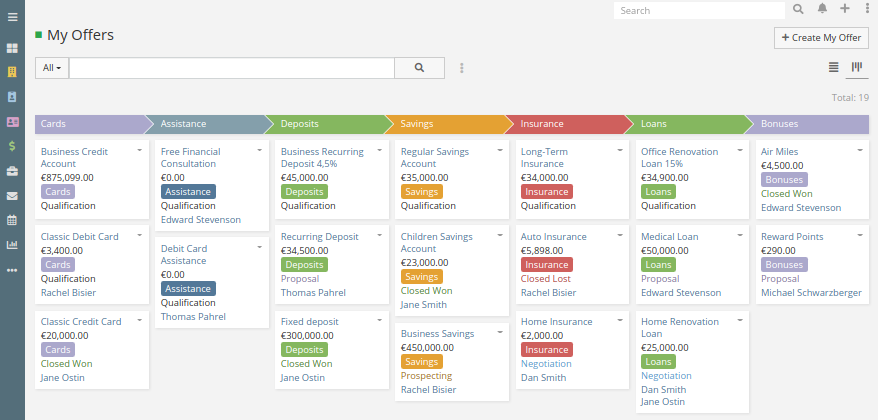

CRM allows tailored, personalized outreach for every customer

Apart from efficiently storing customer information, the CRM system can also analyze the customer’s activity, helping the bank personalize its approach to every customer. This enables the bank to provide relevant information, as well as details that are of particular interest to the customer. This individualized approach will ensure that the clients will feel attended to. It will also guarantee that no customer emails will be tossed directly into the Spam folder. What’s more, a CRM system allows the bank to thoroughly analyze the data that can then help the bank identify its most promising customers, as well as classify them into various categories and assign privileges.

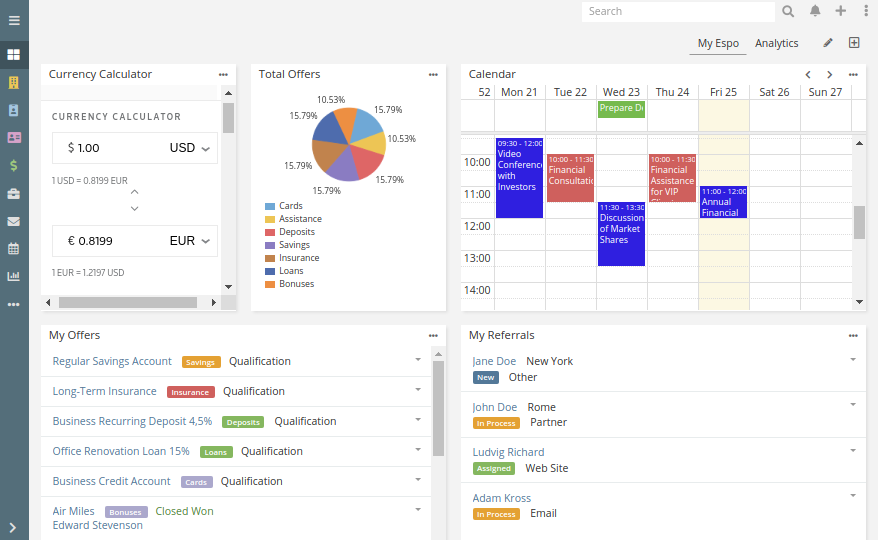

CRM increases banker productivity

The CRM platform goes far beyond simple information storage. It can be used as a powerful tool for work planning. Bankers can easily schedule meetings and calls, organize tasks, and set reminders in order to not to miss an important event. With properly configured business process automation, the software minimizes the number of routine administrative tasks (such as sending reminders to pay bills or refill the balance). It allows bankers to focus more on building relationships with clients, which results in higher conversion rates and increased loan sales.

CRM ensures more efficient inter-department data exchange

Modern businesses run on data. Clicks, likes, website visits, comments, call details, emails, credit history, reviews, and feedback – these are the things that create a full profile of the customer and help to improve not only a bank’s marketing efforts but also its sales and customer support. The right CRM shares access to the needed information across all departments. The gathered data allows the marketing team to create targeted campaigns that address the needs of a customer. Bankers can see what stages of the loan process prevent customers from applying, while customer service representatives spend less time on solving issues as they see the previous actions of the client.

CRM streamlines document management

The other issue with which most large financial institutions struggle is keeping track of their documentation. The larger the enterprise, the more documents it has to deal with and more often the employees face the challenges in managing the clients’ files. All in all, document management proves to be not only prone to error, but also incredibly tedious, leading to poor maintenance, and more wasteful of the client’s time. As a result, the bank can lose both clients and income. If the financial institution can’t find a way out of this vicious circle, it can quickly slip into bankruptcy. However, the introduction of a CRM system can minimize or even completely obliterate these problems. It document management within the entire organization, which results in increased accuracy and precision, as well as superior clarity. What this essentially means is that all important operations, such as approving a loan, will run smoothly and efficiently without being negatively impacted by human errors.

With a constantly growing number of financial institutions, banking tends to become more and more a customer-driven business. In order to succeed in such a competitive environment, banks have to employ customer-centric business models that make understanding and serving the needs of a customer a top priority. Implementing CRM software within the financial institution is the first, vitally important step to establishing strong and loyal connections with your clients. Today, more than ever before, customers are empowered with a choice, and CRM software will help your institution to become that very best choice they can make.

Interested in making your business more efficient? Let’s do it together with EspoCRM!